Prime brokerage gets its wake-up call

Citi’s Asia closures may make sense today – but at what future cost?

16 April, 2021

Nomura: Okuda’s fine work undone by Archegos mess

27 April, 2021Euromoney, April 23 2021

A sign of too much risk and exposure in a frothy market or just two banks that didn’t have their risk management in order? Prime brokerage has become a profitable mainstay for several banks but, as Archegos shows us, it punishes the distracted

There are two schools of thought about the Archegos Capital Management situation and what it tells us about the curious world of prime brokerage.

One is that Archegos is just the start, the first of many chickens coming home to roost. This version holds that too many banks, starved of income by low interest rates and the slow death of cash equities, have committed too much capital to prime brokerage clients without the right risk management policies in place. They have simply replaced the risk they took with structured products a decade ago with another kind of blind-sided leverage, their vision impaired by a glut of total return swap exposures that disguise a client’s overall leverage because you can’t see what positions they hold with other brokers.

Along the way they have shifted from serving the traditional, high-frequency, long-short hedge funds prime brokerage was designed for, to a range of clients who are by turns too big and complicated, too small and fragile, or call themselves family offices when they’re actually highly leveraged, one-man hedge funds eluding proper regulation. The leverage that has been extended to them is asking for trouble in the frothy valuations of a late-stage bull market amid cheap money and a global pandemic.

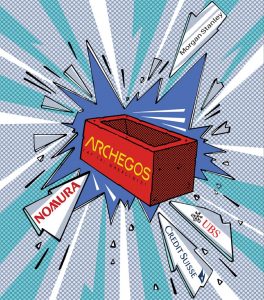

The other version of events is that Archegos is a weird one-off and that prime brokerage is just fine if you’re doing it right, but some people aren’t doing it right. This was an argument that worked in relation to Credit Suisse and Nomura, but then it turned out that Morgan Stanley, about as far from a wide-eyed ingénue as you can get in prime brokerage, lost the best part of a billion dollars on the same client but only got around to mentioning it two weeks later. UBS losing $774 million on Archegos also didn’t help this line of reasoning.

If JPMorgan analyst Kian Abouhossein is right in his conclusion that industry losses could be as high as $10 billion from Archegos, then something has gone badly wrong. Archegos is one, not systemically important, client and it should not be normal for it to have secured five to 10 times leverage – equating to as much as $100 billion of exposure – from six prime brokers and a couple of Japanese banks that have absolutely nothing to do with prime brokerage.

So even if this isn’t as apocalyptic as it could be – like Long-Term Capital Management, when the industry waited for the next shoe to drop and it never really did – it does need to be a wake-up call.